It is no secret that cryptocurrencies have taken the world by storm in recent years. With the rise of Bitcoin, Ethereum, and other digital assets, more and more people are looking to get involved in the exciting world of cryptocurrency trading. However, for many people, the process of buying cryptocurrency can be a confusing and daunting task.

In this article, we will take a step-by-step look at how to buy cryptocurrency in South Africa. We will cover everything from setting up a trading account to making your first trade. So whether you are a complete beginner or an experienced trader, this guide will show you everything you need.

Ways To Buy Bitcoin In South Africa

The first way to buy cryptocurrency in South Africa is by using a Bitcoin exchange. These exchanges are online platforms that allow you to buy, sell, and trade cryptocurrencies. They act as middlemen between buyers and sellers and charge a small fee for their service.

Popular cryptocurrency exchanges in South Africa include Crypto.com and Coinbase.

The second way to buy Bitcoin in South Africa is through a peer-to-peer (P2P) marketplace. These platforms connect buyers and sellers directly and allow them to trade cryptocurrencies without the need for a third party.

Some of the most popular P2P marketplaces in South Africa include LocalBitcoins and Paxful.

The Best Cryptocurrency To Buy In South Africa

Hundreds of cryptocurrencies have been created since the inception of Bitcoin. However, not all of these digital assets are worth investing in. When choosing which cryptocurrency to buy, you need to consider a few factors such as the coin’s technology, team, community, and market potential.

With that said, here are our top 10 picks for the best cryptocurrency to buy in South Africa right now:

1. Bitcoin (BTC)

Arguably the most well-known and widely-traded cryptocurrency in the world, Bitcoin is a great choice for anyone looking to get started in the world of crypto trading. Bitcoin is powered by blockchain technology, which allows it to be used as a store of value, medium of exchange, and unit of account.

2. Ethereum (ETH)

Ethereum is the second-largest cryptocurrency in the world by market capitalization. Like Bitcoin, Ethereum is a decentralized digital asset that can be used as a store of value, medium of exchange, and unit of account. However, Ethereum differentiates itself from Bitcoin with its use of smart contracts, which allows it to be used for a wide variety of applications. Read all about How to Buy Ethereum in South Africa.

Click here for Ethereum Price Prediction

3. Litecoin (LTC)

Litecoin is often referred to as the “silver to Bitcoin’s gold.” Created in 2011, Litecoin is very similar to Bitcoin in terms of features and functionality. However, Litecoin has faster transaction times and lower fees, which makes it a popular choice for small businesses and everyday transactions.

4. Bitcoin Cash (BCH)

A fork of the original Bitcoin blockchain, Bitcoin Cash was created in 2017. The main difference between Bitcoin and Bitcoin Cash is that the latter has an increased block size, which allows for faster and cheaper transactions.

5. Ripple (XRP)

Ripple is a cryptocurrency that was designed for use by financial institutions. Unlike other cryptocurrencies, Ripple cannot be mined but instead is issued by the company behind the project. Ripple is often used by banks and payment processors to settle international payments quickly and cheaply. Read all about How To Buy Ripple (Xrp) In South Africa.

Click here for Xrp Price Prediction

6. Cardano (ADA)

Cardano is a relative newcomer to the world of cryptocurrency, having only been launched in 2017. However, Cardano has quickly established itself as a leading project in the space with its use of smart contracts and decentralized applications.

Click here for Carando (ADA) Price Prediction

7. EOS (EOS)

EOS is another popular blockchain platform that supports the development of decentralized applications. EOS differentiates itself from Ethereum with its focus on scalability, which allows it to process thousands of transactions per second.

8. Stellar (XLM)

Stellar is a distributed ledger protocol that allows for fast and cheap international payments. Stellar is often used by banks and financial institutions as an alternative to Ripple.

9. Dogecoin (DOGE)

DOGE is a popular cryptocurrency that was created as a parody of Bitcoin. However, DOGE has since emerged as a serious project with a large and passionate community. DOGE is often used for tipping content creators and online commentators.

Click here for Dogecoin Price Prediction

10. Shiba Inu (SHIB)

Shiba Inu, like Dogecoin, is a Litecoin fork. It also started as a meme coin, but now has a dedicated following and is being used as a currency on some online marketplaces.

It uses the proof-of-work algorithm scrypt and has a block time of 2.5 minutes. The maximum number of coins that can be mined is 84 million, compared to Dogecoin’s 100 billion.

Payment Methods For Buying Cryptocurrency

When it comes to buying cryptocurrency, there are a few different options available. The most popular methods include:

- Using a credit or debit card: This is one of the easiest and quickest ways to buy crypto. All you need is a credit or debit card and an account with a crypto exchange.

- Using bank transfer: You can also buy cryptocurrency using a bank transfer. This method is usually slower than using a credit or debit card, but it may be more convenient for some users.

- Using PayPal: You can also buy crypto using PayPal. However, not all exchanges support this payment method.

- Using Bitcoin: If you already own some Bitcoin, you can use it to buy other cryptocurrencies. This is a good option for those who want to avoid using fiat currency.

The best payment method for buying cryptocurrency will depend on your individual needs and preferences. For example, if you want to buy crypto quickly and easily, using a credit or debit card is the best option. However, if you want to avoid using fiat currency, you may prefer to use Bitcoin.

How To Buy Cryptocurrency In South Africa – Step By Step

If you’re looking to buy cryptocurrency in South Africa, there are a few things you need to know. Here’s a step-by-step guide:

- Choose a crypto exchange: The first thing you need to do is choose a reputable crypto exchange. You will find a few different exchanges out there, so do your research before choosing one.

- Create an account: Once you’ve chosen an exchange, you’ll need to create an account. Usually, this process simply requires you to provide your email address and create a password.

- Get verified: Most exchanges will require you to verify your identity before you can buy crypto. You will usually upload a copy of your ID or passport to prove your identity.

- Choose your payment method: Once you’re verified, you can choose how you want to pay for your crypto. As mentioned earlier, most exchanges accept credit and debit cards, as well as bank transfers.

- Place your order: Place your order after choosing your payment method. Make sure you know exactly how much crypto you want to buy before placing your order.

- Withdraw your crypto: Once your order has been filled, you can withdraw your crypto to a wallet of your choice. Make sure you know the address of your wallet before withdrawing your crypto.

- Store your crypto securely: After you’ve withdrawn your crypto to a wallet, it’s important to store it securely. This means keeping your private keys safe and avoiding online wallets where possible.

Buying cryptocurrency is a relatively simple process, but there are a few things you need to keep in mind. Make sure you choose a reputable exchange and get verified before buying any crypto. In addition, always store your crypto in a secure wallet to avoid losing it.

Where To Buy Cryptocurrency In South Africa

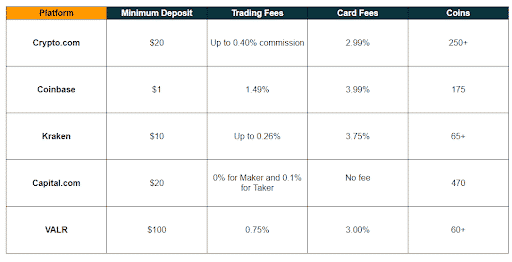

1. Crypto.com

Traders from all over the world choose Crypto.com because of its cheap fee policy and easy yet comprehensive Bitcoin investment program.

Crypto.com, in addition to Bitcoin, supports over 250 other cryptocurrencies, including ETH, DOGE, ADA, LITE, BTC, and many others. When it comes to costs, Crypto.com charges just 0.40 percent commission, which is payable when you purchase and sell Bitcoin.

You can get even cheaper costs when you trade in larger quantities and stake Crypto.com’s in-house digital token, CRO. The Crypto.com app is extremely popular in South Africa since it accepts Visa and MasterCard payments. This means you can buy Bitcoin from anywhere in just a few minutes.

Another alternative is to use a standard bank wire to deposit monies. However, the funds may take a few days to arrive.

After you’ve purchased Bitcoin using the Crypto.com network, you may start earning interest. This is because your BTC tokens may be deposited into a crypto savings account.

You can keep your BTC tokens locked up for one or three months or choose a more flexible withdrawal schedule. The APY you receive is determined by your choice. For example, if you stake CRO and choose a three-month lock-up duration, your Bitcoin deposit will earn six percent interest. If you don’t stake CRO and choose a flexible plan, the APY lowers to 0.5 percent.

The Crypto.com exchange now offers a debit card that you may use to spend Bitcoin anywhere in South Africa and abroad that takes a Visa. Finally, Crypto.com includes a safe Bitcoin wallet in its unique software.

Key Features:

- Prepaid Card: You can now use your Bitcoin to make regular purchases using the Crypto.com prepaid card. This makes it easier to use Bitcoin in your day-to-day life.

- Commission-Free Trading: Crypto.com does not charge any commission when you buy or sell Bitcoin. This makes it one of the cheapest options available.

- Token Staking: If you stake CRO tokens, you can get cheaper costs and earn interest on your Bitcoin deposit.

- Mobile App: The Crypto.com app is available for both Android and iOS devices. This makes it easy to buy Bitcoin on the go.

Fees:

- Trading Fee: Commission-free

- Minimum Deposit: $20 on debit and credit card

2. Coinbase

Coinbase is one of the top crypto exchanges in South Africa for total novices. If you wish to purchase BTC or other popular coins, you can usually execute the transaction in about 10 minutes. This entails creating an account, submitting identification, and attaching a payment method.

A debit or credit card is the quickest way to pay at Coinbase, as it is processed quickly. However, you will be charged a 3.99 percent transaction fee, so keep that in mind. Coinbase also provides bank wire transfers for a considerably lower charge.

On the other hand, Coinbase is pricey when it comes to trading costs, costing 1.49 percent for each transaction. This charge must be paid each time you purchase or sell cryptocurrency.

Coinbase not only provides a user-friendly trading interface but also simplifies the process of holding your digital currency deposits. In reality, the majority of South Africans will store their coins in an online wallet, eliminating the need to worry about private keys.

Instead, you may access your assets at any moment by logging into your Coinbase account. In addition, cold storage (98 percent) and two-factor authentication safeguard your Coinbase online wallet.

Coinbase offers hundreds of tokens, making it a great choice for those looking to invest in a range of different projects. Ethereum, Bitcoin Cash, and Litecoin are currently just 3 of the top 15 cryptocurrencies that can be traded on Coinbase.

Even some altcoins are available on Coinbase, making it a go-to choice for those looking to invest in other digital currencies. Ethereum Classic, 0x, and Basic Attention Token are just a few of the coins that you can trade on Coinbase.

Coinbase also offers merchant processing services, making it easy for businesses to accept Bitcoin and Ethereum payments.

Key Features:

- User-Friendly UI: Coinbase has a user-friendly UI, making it easy for first-time buyers to purchase their desired cryptocurrency.

- Multiple Payment Methods: Coinbase allows you to use multiple payment methods, including debit and credit cards as well as bank wire transfers.

- Diversified Offerings: Coinbase offers a wide variety of cryptocurrencies for buyers to invest in.

- Safe and Secure: Coinbase is a secure platform with two-factor authentication and cold storage features.

Fees:

- Trading Fee: 1.49% Commission

- Minimum Deposit: $50

3. Kraken

Kraken, founded in 2013, is next on our list of the top South African crypto exchanges. As a result, Kraken has maintained its reputation as a reliable exchange for almost a decade.

Margin accounts are one of the standout features of the Kraken platform. This enables you to purchase crypto with a 1:5 margin. For example, if you want to trade $100 worth of BTC, you just need to put up $20 in margin. This is for those who want to invest heavily in cryptocurrencies with more money than you have on hand.

If you’re familiar with financial derivatives trading, Kraken’s Futures trading could be worth a look. This not only allows you to buy long or sell short on your preferred digital currency market, but it also allows you to use the leverage of up to 50x. In other words, a $50,000 position would only require a $1,000 buffer.

If you are not a gambler, you can just purchase and sell cryptocurrency at spot market pricing. Those who trade minimal amounts will only pay a meager 0.26 percent fee. With a maker and taker pricing system, higher volume investors will obtain more competitive commissions.

Kraken provides access to more than 60 crypto spot markets, the majority of which are focused on high-cap projects. You may also access your money on the go by downloading the Kraken trading app.

Kraken does not provide a dedicated wallet where you may keep control of your private keys. Nonetheless, this may be suitable for novices.

Key Features:

- Derivative Trading: Kraken offers Futures trading, which allows you to buy or sell short on your preferred digital currency market and use the leverage of up to 50x.

- 2FA Security: Two-factor authentication is a security feature that requires two forms of identification, one being something you know and the other being something you have.

- Spot Trading: You can purchase and sell cryptocurrency at spot market pricing.

- App: Kraken provides a trading app that you can download to your mobile device for on-the-go trading.

Fees

- Trading Fee: 0.26% Commission

- Minimum Deposit: $10

4. Capital.com

If you want to trade Bitcoin in South Africa, another alternative is to utilize a regulated CFD trading platform. CFD trading means that you never actually own the underlying asset, in this case, Bitcoin. Instead, you are essentially speculating on whether the price will rise or fall and then opening a position based on your prediction.

This is where Capital.com comes in. Capital.com, in its most basic form, allows you to forecast the future price of Bitcoin without having to hold any tokens.

When trading CFDs, you can go long (predicting that the price will go up) or short (predicting that the price will go down). You can also use leverage, which multiplies your potential profits (and losses).

Capital.com is a broker authorized and regulated by the Financial Conduct Authority in the United Kingdom. This means that your money is safe, and you are protected under UK law.

It’s just a matter of determining whether you believe Bitcoin’s value will climb or decline. Capital.com now provides over 470 crypto CFD markets, including BTC/ZAR. This means you may trade Bitcoin’s future worth against the South African rand in a secure, regulated environment.

When it comes to commissions, Capital.com charges a spread on the trade, which is the difference between the buy and sell price.

Capital.com doesn’t charge any other hidden fees, so you can be sure that what you see is what you get. You may also utilize Capital.com’s demo account to practice trading without risking any real money.

It’s common to think of Bitcoin as a gateway to other cryptocurrencies, so it’s important to have a platform where you can buy and sell Bitcoin safely and securely. Capital.com provides this and also gives you access to a range of other cryptos should you wish to expand your portfolio.

Key Features:

- CFD Trading: Capital.com allows you to trade Bitcoin’s future worth against the South African rand in a secure, regulated environment.

- No Hidden Fees: Capital.com doesn’t charge any other hidden fees, so you can be sure that what you see is what you get.

- Demo Account: You may also use Capital.com’s demo account to practice trading without risking any real money.

Fees

- Trading Fee: Zero Commission

- Minimum Deposit: $20

5. VALR

VALR is the last choice to consider while looking for the top Bitcoin exchange in South Africa. They are physically located in South Africa, which may suit those of you looking to buy and sell cryptocurrency on a local platform.

You will be able to use over 60 digital currencies at VALR, including BTC, ETH, SOL, and XRP. All cryptocurrency values are quoted in ZAR. When it comes to costs, both bank wire and cryptocurrency deposits are free of charge. Credit card deposits, on the other hand, are subject to a 3 percent administrative fee.

When using the fast-track service, ZAR withdrawals cost R8.50 or R60. Trades only charge 0.10 percent, which is quite low. You will be charged 0.75 percent if you wish to acquire crypto immediately without dealing with traders. Simple crypto exchanges may be done for 0.85 percent of the deal value.

VALR promises to retain customer assets in cold storage wallets for security reasons, but no percentage statistic is offered. Internal controls include multi-signature procedures and two-factor authentication.

Finally, VALR uses automated onboarding technology, which means you should be able to create an account in minutes.

Key Features:

- Quick Account Creation: VALR uses automated onboarding technology, which means you should be able to create an account in minutes.

- Dedicated Wallet: VALR offers customers a dedicated wallet to store their cryptocurrencies.

- 2FA Security: Two-factor authentication is required for all users to access their accounts.

Fees

- Trading Fee: 0.75%

- Minimum Deposit: $100

FAQ’s

1. What is the best Bitcoin exchange in South Africa?

No one answer will suit everyone when it comes to finding the best Bitcoin exchange in South Africa. It will depend on your individual needs and preferences. However, the five exchanges that we have listed above are all reputable platforms that offer a good range of features and services.

2. How do I buy Bitcoin in South Africa?

The process for buying Bitcoin in South Africa is relatively simple. Firstly, you will need to find a reputable exchange that offers BTC/ZAR trading. Once you have found an exchange, you will need to create an account and deposit funds into it. After your account is funded, you can then start trading BTC/ZAR.

3. What is the difference between a Bitcoin exchange and a Bitcoin wallet?

A Bitcoin exchange is a platform where you can buy, sell, or trade Bitcoin and other cryptocurrencies. On the other hand, a Bitcoin wallet is a software program that allows you to store, send, and receive Bitcoin. You will need to use a wallet in order to store your BTC after you have bought it on an exchange.

4. How do I choose a Bitcoin exchange?

There are a few things that you should consider when choosing a Bitcoin exchange, such as fees, security, coins offered, and customer support. You will also need to make sure that the exchange is available in your country.

5. What are the fees associated with trading cryptocurrency in South Africa?

The fees associated with trading cryptocurrency in South Africa will vary from exchange to exchange. You will need to check the fee schedule of each exchange before you start trading.