Ethereum Price Prediction: Navigating the Future of ETH in 2024

Ethereum’s price in 2024 will depend on upgrades like Dencun, ETF approval, and macro trends. This analysis covers what could push ETH to new highs or keep it under pressure.

Ethereum’s price in 2024 is expected to fluctuate within a wide range, reflecting both strong bullish potential and structural risks. On the lower end, support is seen in the $2,500 to $2,800 area, with $2,274 acting as a key technical level. A drop below this threshold could trigger a deeper correction toward $2,000, although that scenario is currently considered less likely.

If the market sees favorable developments such as spot ETF approvals, growing institutional demand, and increased adoption of Ethereum infrastructure, ETH may reach the $5,000 to $6,000 range. This zone could act as a mid-cycle equilibrium before any further moves.

Under especially strong conditions – including sustained capital inflows and successful scaling via Layer 2 solutions – Ethereum has the potential to reach $8,000 or higher. In some long-range projections, targets around $10,000 are mentioned, although these would likely depend on multiple factors aligning: smooth implementation of network upgrades, improved macroeconomic sentiment, and Ethereum maintaining a leading role in sectors like DeFi, NFTs, and on-chain applications.

Overall, the baseline expectation for late 2024 places ETH in the $4,000 to $5,500 range, with $2,500 as a likely floor and $8,000+ representing the upper bound in a high-momentum scenario.

Forecasting Models and Market Sentiment

Ethereum price forecasts for 2024 draw on technical indicators, historical patterns, and broader market sentiment.

Popular approaches include identifying support and resistance levels, tracking trend continuation, and analyzing momentum through moving averages and RSI. Ethereum holding above its 50-day and 200-day moving averages is typically seen as a positive signal. Some models also use Fibonacci retracement and volume profiles to map breakout zones, with key areas near $2,800 to $3,000 and around $5,000.

Market sentiment remains cautiously optimistic. Anticipation around spot Ethereum ETF approvals has shifted institutional positioning toward accumulation. Expectations of capital inflows, if ETFs are approved, are already reflected in several bullish scenarios. Among retail participants, usage of Ethereum-based applications and Layer 2 networks continues to grow, supporting a positive long-term outlook despite short-term volatility.

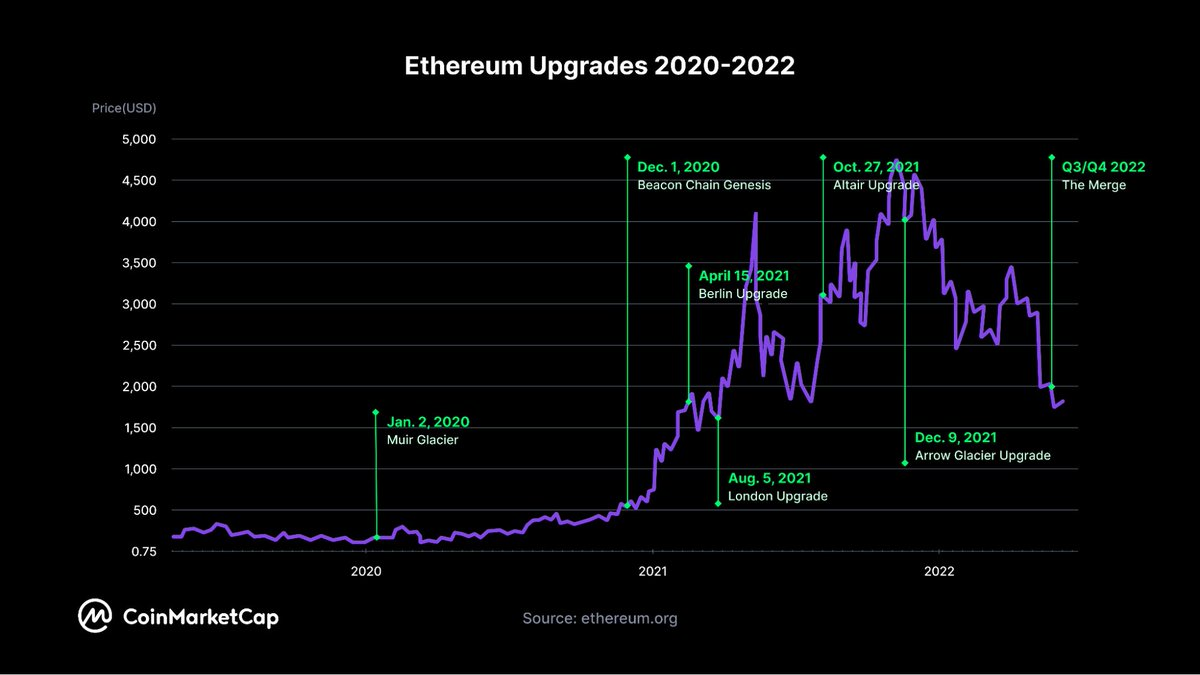

Historically, Ethereum has shown strength following major upgrades. Both the Merge in 2022 and the Shanghai update in 2023 were followed by renewed upward momentum.

If this pattern holds, the Dencun and Petra upgrades scheduled for 2024 could provide similar market catalysts.

Key Drivers Behind Ethereum’s Price in 2024

Network Upgrades. The Dencun upgrade, which includes EIP-4844 (Proto-Danksharding), is among the most anticipated technical developments this year. It is designed to lower transaction costs and improve scalability by introducing data blobs for rollups. Alongside upcoming changes like Petra, these enhancements aim to improve network performance and user experience.

Layer 2 Expansion. Layer 2 networks such as Arbitrum, Optimism, Base, and zkSync continue to grow, increasing Ethereum’s scalability and reducing costs. Rollups move transaction processing off the main chain while settling on Ethereum, supporting long-term value for ETH.

Market Conditions. Metrics like trading volume, volatility, active addresses, and fee generation help assess market strength. Increased on-chain activity and declining exchange balances may signal accumulation, which could provide price support.

Institutional Catalysts. The possible approval of a spot Ethereum ETF is one of the key market drivers this year. Approval could bring substantial institutional inflows. Meanwhile, ETH’s role as a yield-generating asset through staking continues to grow, making it more appealing to long-term investors.

Regulatory Outlook. Clearer regulation will be critical. In the U.S., the SEC’s stance on ETH and its decisions on ETF filings will shape institutional engagement. Internationally, the EU’s MiCA framework and policy developments in Asia may also affect Ethereum’s adoption and investor sentiment.

Macro Environment. Global economic factors such as interest rates, inflation, liquidity cycles, and geopolitical events will continue to influence crypto markets. Shifts in risk appetite or monetary policy can either support or hinder Ethereum’s price trajectory, depending on context and timing.

Ecosystem and Development Activity

Ethereum’s long-term potential is supported by ongoing development and a growing range of real-world applications.

The Ethereum Foundation follows a clear roadmap. Upcoming upgrades like Petra focus on improving efficiency, validator experience, and overall network performance. These changes are designed to create a more scalable and modular ecosystem while lowering entry barriers for users and developers.

Developer activity remains high. Ethereum continues to lead in monthly active developers across the blockchain space, reflecting strong community engagement and innovation. This activity drives growth in decentralized finance, tokenized real-world assets, and a renewed wave of interest in NFTs.

New protocols are emerging within the Ethereum ecosystem, including projects in gaming, artificial intelligence, and social applications. At the same time, rising total value locked in Layer 2 networks such as Arbitrum and Optimism shows increasing user confidence. This trend may continue to support demand for ETH, which remains the core asset securing and powering activity across the network.

Risks and Challenges

Despite a strong outlook, Ethereum still faces several unresolved challenges that could limit growth or delay progress.

Scalability remains an ongoing concern. While Layer 2 solutions reduce pressure on the mainnet, they also introduce complexity and fragmentation. Users and developers must navigate a growing number of rollups with different standards, which can affect interoperability and overall user experience.

Adoption outside the crypto-native audience is still limited. Broader use of Ethereum-based applications will require better onboarding, faster performance, and more predictable fees.

There is also execution risk. Delays in implementing upgrades like Dencun or Petra could slow momentum. As Ethereum’s infrastructure becomes more complex, the chance of technical bugs or unforeseen issues increases. Validator centralization is another concern, as it may weaken the network’s long-term resilience and neutrality if left unaddressed.

Beyond 2024: Long-Term Outlook

Ethereum is steadily establishing itself as a core infrastructure layer for the next generation of the internet. Its ability to support decentralized applications, trustless finance, and tokenized assets places it at the center of the evolving Web3 landscape.

Over the long term, Ethereum’s success will depend on its capacity to scale while preserving security and decentralization. If the network continues to lead in areas such as DeFi, NFTs, Layer 2 development, and real-world applications, ETH could strengthen its position as both a utility token and a broader financial asset.

Looking beyond 2024, Ethereum may serve as a global settlement layer for tokenized finance, a hub for open innovation, or a yield-bearing asset integrated into institutional portfolios. Its trajectory will be shaped by regulatory developments, technical progress, and the network’s ability to meet growing user demands.

The information published on CoinRevolution is intended solely for general knowledge and should not be considered financial advice.

While we aim to keep our content accurate and current, we make no warranties regarding its completeness, reliability, or precision. CoinRevolution bears no responsibility for any losses, errors, or decisions made based on the material provided. Always do your own research before making financial choices, and consult with a qualified professional. For more details, refer to our Terms of Use, Privacy Policy, and Disclaimers.