FP Markets is considered to be one of the oldest and most reputable online forex brokerage companies in the industry. The firm has been around since 2005, providing traders with access to several financial markets and a wide range of assets. FPMarkets is fully regulated by Australian authorities, which allows it to give traders safe access to stocks, cryptocurrencies, forex, indices, commodities, options, and ETFs. The broker has been able to attract some of the leading traders in the world due to the features it offers, which include a daily market report, economic calendar, video tutorials, market analysis, top quality customer service, a range of intuitive trading platforms and more.

Despite FP Markets’ status as one of the most significant and most popular brokerage platforms in the industry, we had to review their features and services and to determine just how good they are. Also, we had to know how their services compare with some of its top competitors in the industry. To achieve our objective, we opened a live trading account, funded it with real money, and proceeded to test the essential services FP Markets has to offer. After testing their services, we put together this review, which is 100% honest and unbiased. The review is aimed at informing traders about what FP Markets has to offer and if it will meet your trading needs. The contents of this review also include other user reviews, regarding their experience with FP Markets so you will get an overview of everything you will need to know before you start trading online.

FP Markets Broker Review – Know the Facts, Trade with Confidence

FP Markets is a fully regulated online forex brokerage platform that aims to become the ultimate destination for traders to access the financial markets. They state that they want to make it convenient for traders to be able to trade cryptocurrencies, stocks, currencies, commodities, metals, indices, futures, and more on their platform. Due to their lofty place in the industry, we decided to test their services. We opened a live trading account with FP Markets and funded it with real cash. This enabled us to adequately test their features and to provide you with this comprehensive review. Here is a detailed summary of everything you need to know about FPMarkets.

| PROS | CONS |

|

|

What Makes FP Markets Unique?

FP Markets has been able to maintain its status as one of the leading forex brokers in the industry due to the services it offers. In the first instance, FPMarkets allows traders to choose any of their favorite trading platforms. FPMarkets supports the MetaTrader4, MetaTrader5, and the WebTrader trading platforms. The user interface for all these trading platforms is easy to navigate for traders, and they come with numerous tools to help users with their trading activities. There are many leading brokers that offer access to both WebTrader and MetaTrader platforms so remember that you do have options when it comes to selecting a broker to partner with.

Secondly, the fees and spreads available are some of the best you can find in the industry. FP Markets doesn’t charge users transaction fees. As a result, any withdrawal or deposit of funds that you carry out on FP Markets is entirely free of charges. However, your financial institution might charge you for the transactions so take the time to check this with your bank. FP Markets offers tight spreads, starting from 0.0 on most trades.

As one of the largest forex and CFD brokers in the industry, FP Markets provides access to thousands of financial assets. While most brokers focus on 200+ financial instruments, FP Markets currently give traders access to over 10,000 financial instruments. This means that virtually all assets under stocks, forex, cryptos, commodities, indices, futures, and more, can be found on the FP Markets platforms. Over the past few years, FP Markets has handled transactions worth trillions of dollars for millions of clients. In addition, due to its massive liquidity as a company, the deposit and withdrawal of funds on FP Markets are relatively straightforward.

FP Markets Experience Test

As a trader, few services matter to us over the others. This is because these services are critical to our success as trader, and when inadequate, we could record losses in our trading activities. We used these services to determine the efficiency level of a brokerage platform. FP Markets is considered to be one of the leading global forex brokerage sites. We tested the essential services using the real account we opened.

The first test we conducted was on their withdrawal process. The ability to withdraw your earnings when you need to, is important to traders as it shows that a platform can be trusted with users’ funds at all times. After opening an account, we deposited funds into our trading account. Immediately, we became eligible to withdraw our money, even without trading. We filled out a payment withdrawal request form and submitted it to the customer support team with our identification documents. We got a response in less than an hour. Our request was approved, and the funds were sent to our bank account. If you are using payment methods like credit cards and e-wallets, the funds will reflect in your account almost instantly. However, it will take 3-5 days to reflect in your account if you are using the bank wire payment method.

The second service we tested was their customer service. Whether in the trading industry or any other sector, effective customer service is essential to the success of the users. In this aspect, FP Markets performed excellently. The customer support team can be contacted via email, phone call, or the live chat feature available on the site. We submitted a ticket to the customer support team regarding a question, and we got a reply within a few minutes. The customer care agents promised to look into it and resolved our issue in less than an hour. This allowed us to continue with our trading activities, without missing much.

The third and final crucial test was their trading platform. FP Markets currently supports the three most popular and widely used trading platforms; MT4, MT5, and WebTrader as well as the Iress trading platform. Each of these platforms is uniquely designed to make it easy for traders to navigate the financial markets. They also come with several tools to help traders with their trading activities. We placed buy orders on each of the trading platforms, and the orders were executed within seconds. Considering the nature of the financial markets, we didn’t lose good trades because of the speed of the platforms. We recorded similar results when we placed sell orders on each of the trading platforms.

The three services reviewed above are crucial to the success of financial markets traders. FP Markets provides these services effectively to its customers. After testing the three services, we can recommend FP Markets to be your broker when it comes to crypto, forex, stocks, indices, commodities, and metals trading. If you are looking for other specific services that are not offered by FP Markets, take the time to view the services of other quality brokers in the industry.

Is FP Markets a Scam or Legit?

As a trader, it is vital that you know the legitimacy status of a platform before you trade with them. Knowing the status of a broker will help you decide whether you can trade with them safely or not. After reviewing their services, we can attest to the fact that FP Markets is a legit forex and CFDs brokerage company.

The first proof of their legitimacy is the fact that they are a regulated company. The company is regulated by ASIC, the Australian financial regulator. This means that they follow all the rules put in place by the agency, which are in line with the global regulations. Since it is regulated by ASIC, FP Markets has to carry out services that ensure that traders have fair access to the markets as well as protect their funds and data.

FP Markets is a reputable forex and CFDs brokerage company that has been around for nearly 15 years. During that period, it handled transactions worth trillions of dollars for millions of clients. They allow customers to trade over 10,000 financial instruments in the crypto, forex, stock, commodities, indices, options, and metal markets.

As a regulated company, FP Markets abides by the Anti-Money Laundering (AML) and Know-Your-Customer (KYC) policies, put in place to control the activities in the financial markets. The policies were put in place to boost transparency and to help protect user funds and data.

The AML and KYC regulations are in place to help combat some crimes carried out via the financial markets. FP Markets require all traders to verify their identity and location as it helps them secure user data and funds. Traders are required to verify their identity and location before they can carry out certain crucial activities, such as funds withdrawal. Based on this, ensure that you have the relevant documents to prove your ID and residence while opening an account with FP Markets. Remember that it is a standard procedure and all regulated and reputable brokers will require this information from you if you partner with them.

The terms and conditions page is an explicit instruction to traders on the policies of FP Markets. It contains everything they need to know about FP Markets and how they operate, their criteria for certain activities, and other relevant information. FP Markets is comprised of highly experienced professionals with years of experience trading in the financial markets. As a result, you can be sure of dealing with people who understand the markets.

In terms of security, FP Markets is considered to be one of the leading brokers in the industry. The payment system has been streamlined to ensure that both deposit and withdrawal of funds are carried out smoothly, safely, and securely. The security protocols are highly efficient and ensure that the funds and data of traders are kept safe and remain private all times. Thus, you can be sure of withdrawing and depositing your funds whenever you want, without encountering any issues.

FP Markets respects its users’ privacy and this is the reason why it doesn’t share or sell its users’ data to any third-party or affiliate company for marketing purposes. The data provided by traders remains confidential at all times.

FP Markets Regulation and Safety of Funds

FP Markets is a regulated forex and CFD broker. The company is regulated by the Australian Securities and Investments Commission (ASIC), which means that they operate within the confines of the financial laws. As a regulated broker, FP Markets fully abides by the international and local regulations guiding financial market service providers.

FP Markets requires its clients to comply with the AML and KYC policies, which requires them to verify their identity and location. The policies are put in place to help curb crimes such as identity theft, terrorism funding, money laundering, and others.

The company also ensures the safety of user funds at all times. FP Markets has put in place some high-level security measures that allow traders to carry out financial transactions seamlessly on their website in a secure and effective manner. The company’s funds are stored separately with the client funds to ensure client funds are always available and secure. FP Markets banks with some of the leading banking institutions in the world thereby ensuring that traders have access to their cash on demand. In general, FP Markets has robust security protocols that meet international standards and they always ensure that traders can freely use or store their data and funds on their platform.

FP Markets – Account Types

FP Markets offers five account types, two under the regular forex account, and three under the Iress platform. The account types differ in the services they offer to clients and are tailored for traders from different experience levels. Despite the slight differences in the account types, they are all designed to make it easier for traders to access the financial markets.

Forex Account Types

Under the forex account type, there are two account types:

Standard

The first account available is the Standard account. This account type has a minimum deposit amount of AUD$100 and supports both the MT4 and MT5 trading platforms. FP Markets doesn’t charge commissions for transactions carried out using this account type. The spreads on the Standard account start from 1.0, and traders get to enjoy leverage of 1:500 on financial assets.

Raw

The second account type under this category is the Raw account. Raw has a minimum deposit amount of AUD$100 and supports both the MT4 and MT5 trading platforms. Unlike the Standard account, Raw account users are charged $3 as commission for transactions carried out on the platform. The spreads here start from 0.0, and users get to enjoy a leverage of 1:500 on the financial instruments.

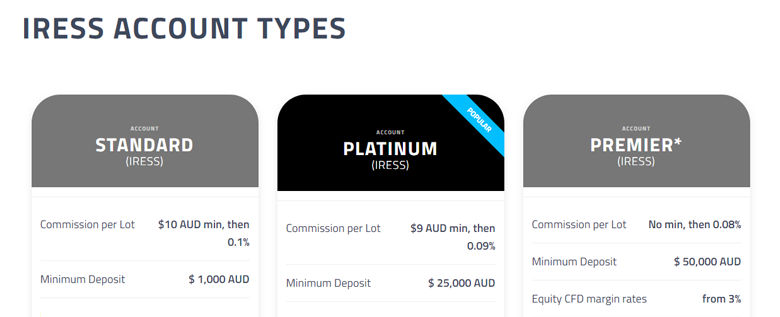

Iress Account Types

The Iress account types are individual accounts created to accommodate Iress trading platform users. This trading platform comes with some advanced functionalities and is usually used by experienced traders.

Standard

The Standard account type here supports only the Iress trading platform. The minimum deposit amount is AUD$ 1,000, with a commission per lot of $10 AUD min, then 0.1%. The equity CFD margin rates start from 3%, while the FP Markets base rate starts from 4%.

Platinum

The Platinum account type also supports the Iress trading platform, but not the MT4, MT5, or WebTrader platforms. The minimum deposit amount on the Platinum account is AUD$ 25,000, with a commission per lot of $9 AUD min, then 0.09%. Similar to the standard account, the equity CFD margin rates start from 3%, however, its FP Markets Base Rate begins at 3.5%.

Premier

This is the highest account type obtainable at FP Markets, and it supports only the Iress trading platform. The minimum deposit sum here is AUD$ 50,000, with no minimum commission per lot, then 0.08%. The equity CFD margin rates also start from 3%, while the FP Markets Base Rate begins from 3%.

Despite the differences in the features offered to customers, all account users get to enjoy exceptional customer service, have access to a wide range of educational materials and trading tools, as well as access to trade the thousands of financial assets on the platforms. Like many other top brokers, FP Markets also offers an Islamic account tailored for Muslim traders who follow Sharia law.

<<<REGISTER HERE TO OPEN ACCOUNT>>>

FPMarkets Trading Conditions

The market conditions on FP Markets are:

- Trading times are in GMT+2 or GMT+3 (when New York Daylight savings takes effect)

- All the FX currency pairs on FP Markets trade 24 hours a day with a break for two minutes between 23:59 and 00:01.

- The trading week starts on Monday at 00:02 and closes on Friday at 23:57

- Positions can be automatically opened and closed

- Spreads start from 0.0, depending on the account type

- Iress fees and charges differ from that of MT4, MT5, and WebTrader

- The holiday trading hours vary for each of the trading platforms

- Leverage is as high as 1:500 for each of the financial assets

Fees and Spreads

FP Markets doesn’t charge a commission on some of its account types and trades. However, the fees charged by the broker are very reasonable, if applicable. For forex trades on Raw accounts, FP Markets charges 3.50 (AUD) and the same amount for metals. For the Iress account types, FP Markets charges traders a wide range of fees, depending on the country and the financial instruments.

FP Markets offer traders very tight spreads on their trades. For the Standard account users, the spreads start from 1.0 pips, while that of Raw accounts begin from 0.0 pips. The spreads are very competitive and allow traders to take advantage of the opportunities in the markets.

Account Opening Experience

Registering with FP Markets and getting an account with them is usually a simple and straightforward process. Opening an account with them would give you the opportunity to access the financial markets, including stocks, forex, indices, commodities and cryptocurrencies.

To open an FP Markets account, visit the broker’s official site. At the top right corner of the platform, you will see the ‘OPEN LIVE’ tab. Click on the tab, and you will be redirected to the registration page.

The registration process is divided into five stages. In the first stage, you will be required to provide your personal information such as full name, account type, country of residence, email address, and a phone number. In the second stage, you will be asked to provide more details about yourself. The details required include date of birth, residential address, employment status, and occupation.

The third process involves selecting your trading account type. You will be asked to choose your preferred trading platform, account type, and base currency. The final stage is a questionnaire, where the team gets the opportunity to know you. After filling out the survey and agreeing to their terms and conditions, your account will be opened instantly. You can proceed to verify your account, fund it, and start trading your favorite financial instruments.

Deposit and Withdrawals

FP Markets supports a wide range of payment methods, which makes it easier for traders to fund their accounts quickly. To deposit funds to your FP Markets trading account, follow the steps below:

- Login to your FP Markets trading account and navigate to the ‘DEPOSIT’ button at the top right corner

- Click on the button and choose your preferred method

- Insert your card, PayPal, e-wallet, or bank details and the amount you wish to deposit

- Submit your deposit application, and the funds will reflect in your account instantly.

FP Markets supports numerous payment methods including;

PayPal

PayPal is one of the largest online payment platforms, and FP Markets supports it. You can deposit funds from PayPal with any of the following currencies; AUD, CAD, EUR, GBP, HKD, JPY, SGD, and USD. There are no transaction fees for MT4 and MT5 trading accounts, but Iress accounts are charged a 2% fee on deposits. The funds will be deposited into your FP Markets account instantly.

Credit/Debit Cards

This is the most widely used payment method. FP Markets accepts credit and debit cards such as Visa, MasterCard, and a few others. There are no transaction fees for MT4 and MT5 trading accounts, however, Iress accounts are charged 1.6% for AUD and 3.18% for other currencies. You can use credit and debit cards to deposit funds in CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, and USD. All transactions are processed instantly, and accounts are credited in less than an hour.

Electronic Wallets

FP Markets also accept payment from electronic wallets. Some of the e-wallets accepted include Neteller, Skrill, Bpay, Fasapay, Poli Pay, PayTrust, and more. User accounts are funded instantly, and FP Markets doesn’t charge transaction fees.

Bank Wire

FP Markets accepts both local and international bank wire transactions. It takes 1 business day for the funds to reflect in your bank account. For domestic transactions, there is no transaction fee, while international bank wire attracts a fee of 12.5 AUD per transaction.

Broker to Broker

You can transfer your funds from another brokerage platform to FP Markets. It takes one business day for the funds to reach your FP Markets trading account. For domestic transactions, there are no transaction fees, while an international brokerage transfer attracts a fee of 25 AUD per deposit.

Similar to the deposit of funds, you can easily withdraw your earnings from FP Markets, however, you need to verify your ID and residence before you are allowed to withdraw your funds. To withdraw your earnings from FP Markets, kindly follow these steps:

- Login to your FP Markets trading account and click on the ‘TRADING’ icon on the top right corner

- Navigate to ‘FUNDS WITHDRAWAL’ and click on it.

- Choose your preferred withdrawal method and insert your details

- Provide the amount you wish to withdraw and submit the request

- Your request is reviewed and approved in less than an hour, if all documentation is provided, and your account will be credited. For bank wire transfer, it could take more than a day for the funds to reach your bank account.

Account Verification

FP Markets require users to verify their accounts before they can withdraw funds or carry out any other transaction.

Proof of Identification

FP Markets requires you to prove your identity in accordance with the AML and KYC policies. The accepted documents are:

- National ID card

- Driver’s license

- International passport

The copies to be submitted need to be clear and must show the name of the trader, date of birth, signature, and other essential information.

Proof of Residence

FP Markets also require users to verify their address. Some of the documents accepted include:

- Utility bills (electricity, water, others)

- Bank statement

FP Markets Trading Platform

FP Markets is unique in that it supports four different trading platforms. The MT4 and MT5 are the most popular trading platforms as they are used by a wide range of traders and are also offered by many top-notch brokers. FP Markets traders using these trading platforms get to enjoy fast order execution, demo accounts, expert advisors (EAs), multiple price charts, pending orders and trailing stop orders, live streaming on both demo and live trading accounts, market news, one-click trading, and a wide range of other features.

FP Markets also uses the WebTrader platform, which is the easiest to use since it doesn’t require any software download. The WebTrader platform comes with several tools, such as a demo account, market news, economic calendar, market analysis, price charts, and more.

Lastly, FP Markets also supports the Iress trading platform. This is a new and improved active trading platform that comes with advanced functionalities. This enhanced trading tool makes it more suited for highly experienced traders. You can enjoy features such as multiple trading portfolios, access to accurate exchange pricing and market depth, real-time price streaming of assets, easy to use interface, improved browser notifications, and more.

Regardless of the trading platform you use, traders will have access to the thousands of assets on FP Markets and will enjoy the exceptional customer service provided.

Education and Resources

FP Markets has a vast catalog of educational materials available to help traders better understand the markets. Traders can take trading courses to learn new strategies about trading. They also have access to eBooks, video tutorials, a glossary, and a newsletter. The materials are available to both new and existing traders to help them gain more knowledge of trading online.

Similarly, FP Markets provides traders with various trading tools. Traders can access some tools such as daily market news, the week ahead report, daily market report, economic calendar, market analysis, and more. These tools enable traders to keep track of the latest events within the markets and to make informed trading decisions.

Customer Service

The customer service at FP Markets is exceptional. The team is comprised of highly professional and friendly members, who have an in-depth knowledge of the financial markets. They handle customer issues instantly to ensure that traders get to trade financial assets conveniently. You can contact the customer care team via a phone call, email, or the live chat feature available on the site.

Frequently Asked Questions (FAQs)

Is FPMarkets Regulated?

FP Markets is regulated by the ASIC. As a regulated company, FP Markets adheres to the local and international policies guiding the financial markets, including the AML and KYC policies.

What is FP Markets?

FP Markets is an Australian-based forex and CFD brokerage company that provides traders all over the world with access to the financial markets. Traders can trade stocks, currencies, cryptos, indices, commodities, futures, options, and metals on FP Markets. The platform charges users transaction fees and trading fees in exchange for their services.

Who has Experience with FP Markets?

FP Markets is designed for all classes of traders. The trading platforms and tools available make it easy for both newbie and experienced traders to navigate the financial markets. Their services are not limited to Australia as they grant traders in other parts of the world access to the financial markets.

How does FP Markets Work?

FP Markets allow traders to trade thousands of financial instruments available on their platforms. The assets include stocks, forex, cryptos, commodities, metals, indices, and options markets. In exchange, FP Markets charges traders commissions and trade fees for providing them with such services.

How Reputable are FP Markets?

FP Markets is a very reputable online brokerage company. The firm is regulated by ASIC and complies with international and domestic financial policies. Over the past few years, FP Markets has handled trillions of dollars’ worth of transactions from millions of customers around the world. You can be confident that your data and funds are safe, thanks to their robust security protocols.

How do I Open an Account with FP Markets?

To open an account with FP Markets, follow these steps:

- Visit the official FP Markets website

- Click on the ‘OPEN LIVE’ tab

- Provide the necessary details in each of the four registration categories

- Submit your ID and residency verification documents

- Complete your registration and deposit funds to get started.

Where is FPMARKETS Based?

The company’s office is located in Sydney, Australia. You can find them at First Prudential Markets Pty Ltd Level 5, Exchange House 10 Bridge St Sydney NSW 2000 AUSTRALIA

While FP Markets may tick all the right boxes for some traders, it is vital to understand your trading needs and preferences and to find the best broker that meets these needs.

Overall Rating: 8/10