Chile’s apex bank, Banco Central de Chile (BCC), has extended its timeline for developing a framework for rolling out its Central Bank Digital Currency (CBDC). As the program was being rolled out in September 2021, the BCC announced that it would wind up the project in early 2022. Following the timeline extension, the bank is now poised to finalize the CBDC project by year-end.

The BCC Aims to Increase Financial Inclusion in the Country

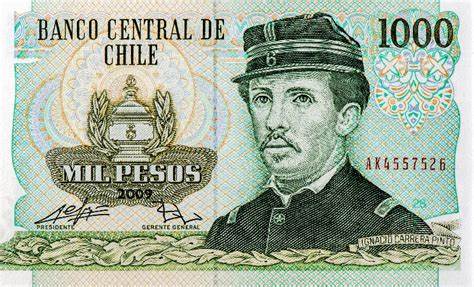

By issuing the digital Peso, the BCC is positive that they will be able to cushion Chileans from investing in the volatile Cryptocurrencies. Like tech or big pharma stocks attracting high bid orders in the financial market, Cryptocurrencies are volatile, and the market cycles are increasingly correlating to stock market trends. Chile aims to offer a more stable payment alternative that is not susceptible to cyclical trends.

The BCC believes that a CBDC Peso will offer a more innovative, competitive, integrated payment system. This move would spur financial inclusivity and resilience of the financial system and offer the public an alternative payment system that they can trust.

The Bank is Receiving Feedback from Stakeholders

The Chilean central bank is not developing the CBDC in isolation. It receives input from stakeholders such as Crypto investors, Blockchain developers, and fintech experts. The BCC will roll out seminars, presentations, and meetings in the coming months. The series of interactions and input acceptance will culminate in crafting a report that will be used to formulate the blueprint of a CBDC platform.

Central and Reserve Banks, Financial market regulators such as the Abu Dhabi FSRA, and governments are increasingly calling for public participation as they seek to develop any Blockchain or Crypto related policy. The democratization of the policymaking process revolutionizes the Crypto and Blockchain space and promotes its development.

Development of CBDC Projects is Taking Longer Than Previously Anticipated

The Banco Central de Chile (BCC) is not the pioneer in issuing a CBDC. The Hong Kong Monetary Authority (HKMA), the People’s Bank of China, the European Central Bank (ECB), and the Bank of Israel (BOI) have also rolled out similar projects. However, none of them have successfully unveiled a self-supporting CBDC, and their projects are still in progress.

The People’s Bank of China is at an advanced stage in developing its electronic Yuan, dubbed the e-CNY. China’s central bank is piloting CBDC in the Zhejiang province cities of Shaoxing, Hangzhou, and Jinhua.

Meanwhile, the Bank of International Settlements (BIS) is confident that more Central banks will unveil their CBDCs to facilitate seamless cross-border payments. According to a BIS study, nine out of ten Central Banks have CBDC projects in progress.