Bitcoin Eyes $120K Milestone as Crypto Markets Heat Up This Summer

Bitcoin consolidates near $120K, Ethereum approaches key resistance, and altcoins show selective strength as traders eye a potential rotation. Key levels and catalysts to monitor through August.

The crypto market enters midsummer with conflicting signals. Capital inflows remain strong, pushing total market cap above $3.4 trillion, while volatility and sector rotation keep traders on edge.

Bitcoin hovers near $120K after hitting new highs, but momentum is uneven. Institutional demand is rising, boosted by ETF adoption, and investor focus is shifting toward AI-linked tokens and altcoin narratives. As capital searches for direction, altseason speculation is building.

Macro Backdrop: The Summer Shaped by Geopolitics and Policy

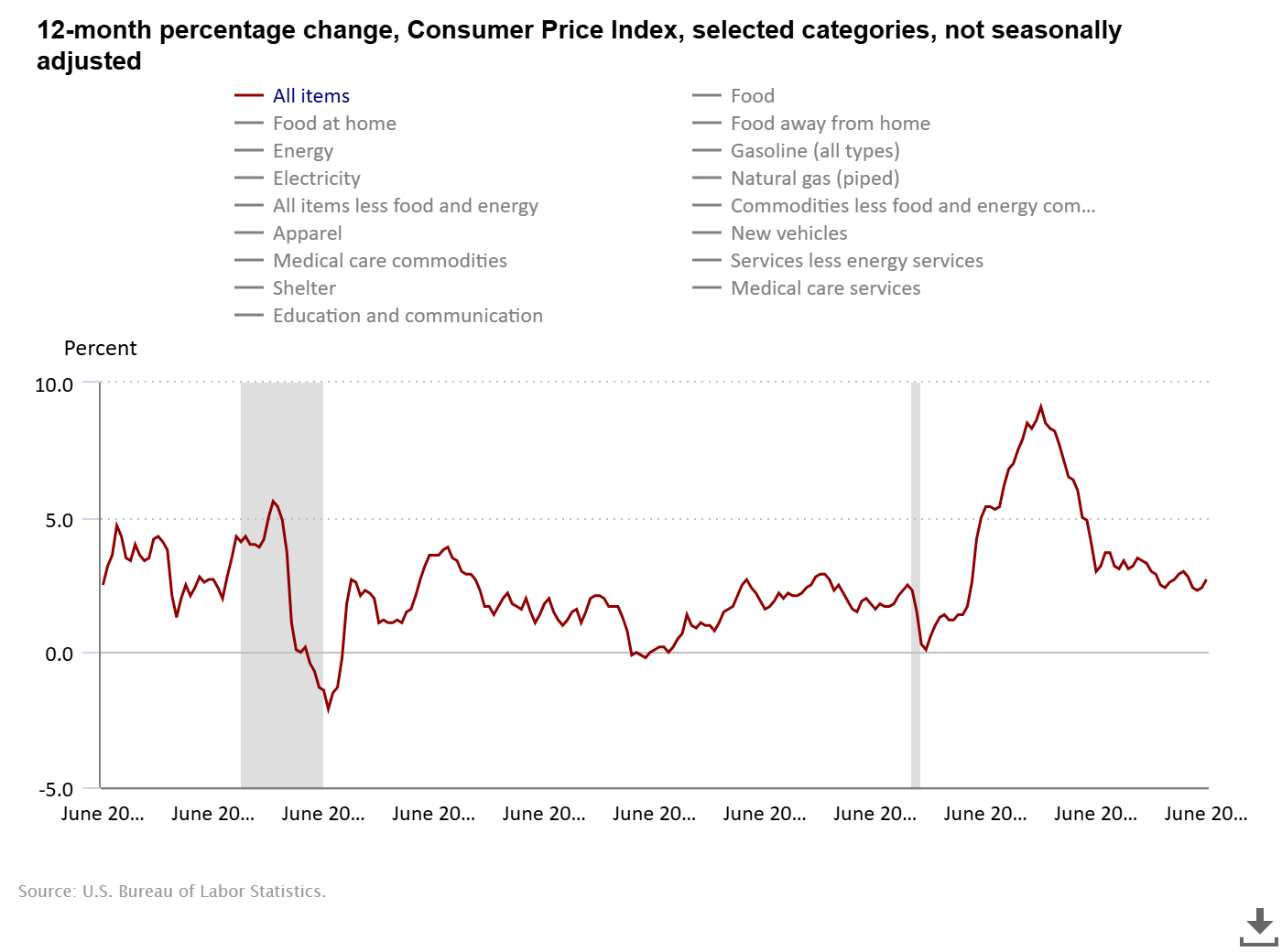

Macroeconomic and geopolitical dynamics are setting the tone for crypto markets this summer. The Federal Reserve is expected to keep rates steady at 4.25 to 4.50%, but June inflation came in hotter than expected at 2.7%, dampening risk appetite. Still, Bitcoin has begun to decouple from traditional equities. While the S&P 500 saw sharp declines earlier in the year, BTC rallied alongside gold, positioning itself as a potential inflation hedge. This shift in correlation has attracted capital flows into crypto during equity pullbacks.

On the policy front, the regulatory environment is cautiously improving. The U.S. House passed the pro-innovation GENIUS Act, and Europe is rolling out its MiCA framework. Meanwhile, ETF expansion continues, with new products broadening retail and institutional access. Geopolitical risks, including trade tensions and instability in the Middle East, add to market uncertainty.

Despite this, crypto has shown resilience, with total market capitalization holding above $3.4 trillion. For now, policy stability and controlled inflation are helping support risk assets, including digital ones.

Bitcoin and Ethereum: Consolidation or Breakout?

Bitcoin recently hit a new all-time high near $123,000 before pulling back to around $117,000. Price action now hovers in a tight range, with $115,000 to $120,000 acting as key resistance and the psychological $100,000 level serving as strong support. Momentum has cooled slightly, but the uptrend structure remains intact as long as BTC stays above six figures.

Ethereum is showing renewed strength. The asset climbed past $3,800 last week, its highest level in over a year, driven by ETF speculation and a surge in layer-2 activity. Technically, ETH is approaching the $4,000 threshold, a key resistance zone tied to its previous cycle highs. A clean break could open the door to $4,400 and beyond.

Notably, ETH is beginning to outperform BTC in the short term, suggesting a decoupling between the two. This rotation of capital is typical in maturing bull markets.

For now, both assets appear technically sound, but further upside may depend on macro cues and investor appetite heading into late summer.

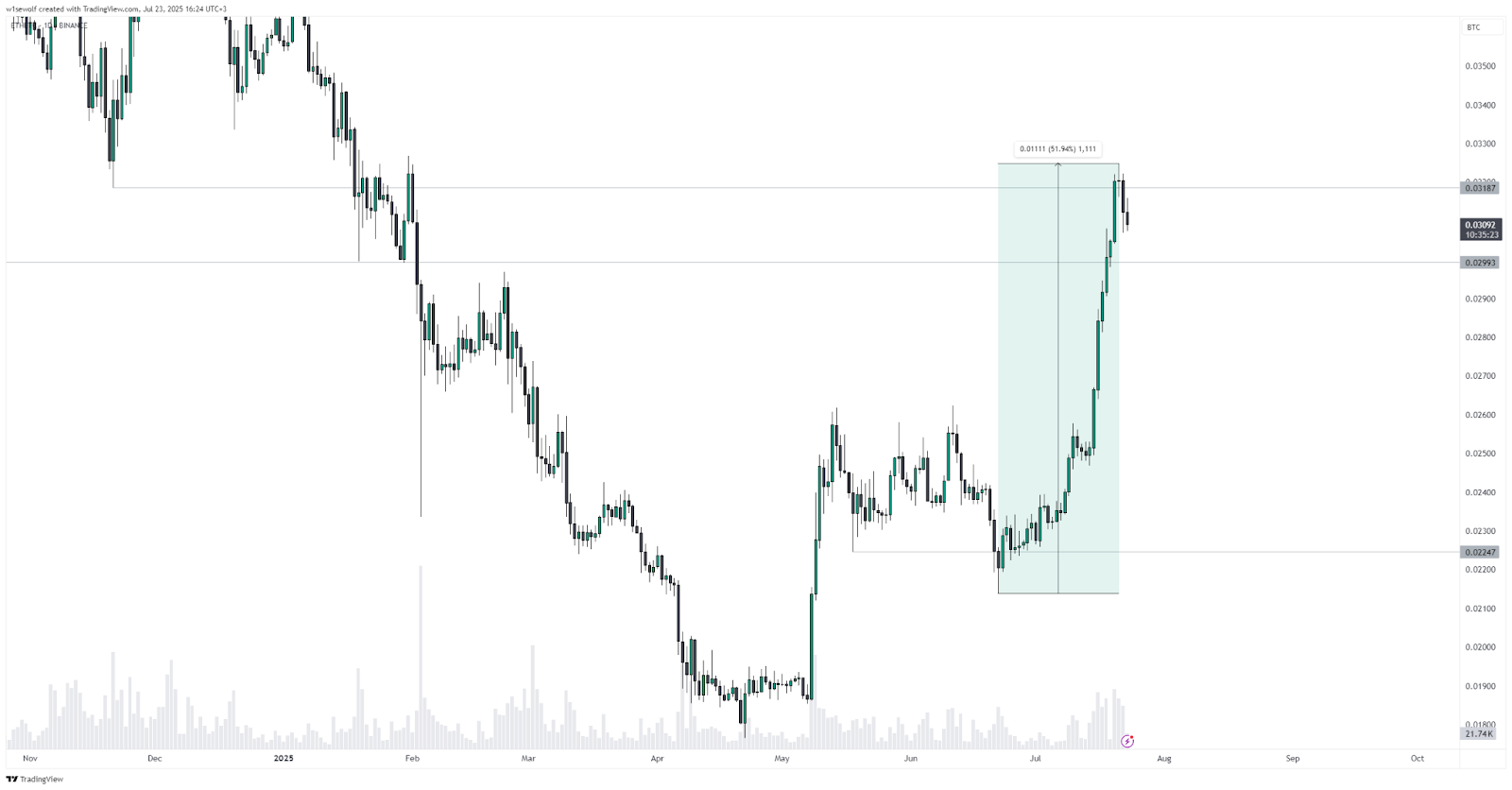

Altcoins: Waiting for Rotation

Bitcoin dominance remains elevated at 64%, which means a true altseason has yet to begin. Capital continues to favor large caps, and until BTC loses ground, widespread rallies in altcoins are likely to stay limited.

Still, there are signs of growing interest. Many altcoins are showing oversold conditions on the RSI, while the total altcoin market capitalization is holding above $1.1 trillion. This suggests that investors are positioning ahead of a possible rotation, favoring projects with stronger fundamentals and real-world traction.

Notable gainers include Solana, driven by rising total value locked and renewed optimism around the Firedancer validator client. XRP is also outperforming, bolstered by record fund inflows, ETF speculation, and new institutional partnerships. Emerging tokens like HYPE and SEI are also gaining momentum on strong technical setups and niche adoption.

Meanwhile, meme-driven assets such as TRUMP and WIF remain highly reactive to news cycles. These tokens tend to see sharp, short-lived rallies, offering opportunities for speculators but little in terms of structural upside. For now, altcoin strength remains selective and theme-driven.

Outlook: Cautious Optimism Into Late Summer

The coming weeks may define the next leg of the market cycle. Key catalysts include a breakout above 125,000 dollars for Bitcoin and a clean move past 4,000 for Ethereum. A decline in Bitcoin dominance and continued regulatory clarity, especially around ETFs and stablecoins, could further shift sentiment in favor of altcoins.

Still, risks remain. Inflation surprises, geopolitical tensions, or abrupt policy shifts could disrupt the current momentum. Market participants should remain alert to macroeconomic data releases and political developments that may influence risk appetite.

The most likely short-term path is continued consolidation within the upper range. However, if Bitcoin and Ethereum break above resistance levels with strong volume, a broader risk-on rally could unfold. In that case, a delayed but stronger altseason may emerge in August, particularly if capital starts rotating into mid-cap assets. The market is leaning bullish, but with a cautious tone.

The information published on CoinRevolution is intended solely for general knowledge and should not be considered financial advice.

While we aim to keep our content accurate and current, we make no warranties regarding its completeness, reliability, or precision. CoinRevolution bears no responsibility for any losses, errors, or decisions made based on the material provided. Always do your own research before making financial choices, and consult with a qualified professional. For more details, refer to our Terms of Use, Privacy Policy, and Disclaimers.