In recent times, the Bitcoin network has witnessed a noticeable decline in transaction numbers, hitting a level that has not been seen in three years, indicating a growing sentiment of disinterest within the cryptocurrency market. This situation presents a complex landscape for both current and prospective investors, underscoring the need for a deeper analysis of market trends and the potential implications for the future of Bitcoin.

Bitcoin Transaction Numbers Experiencing Steep Decline

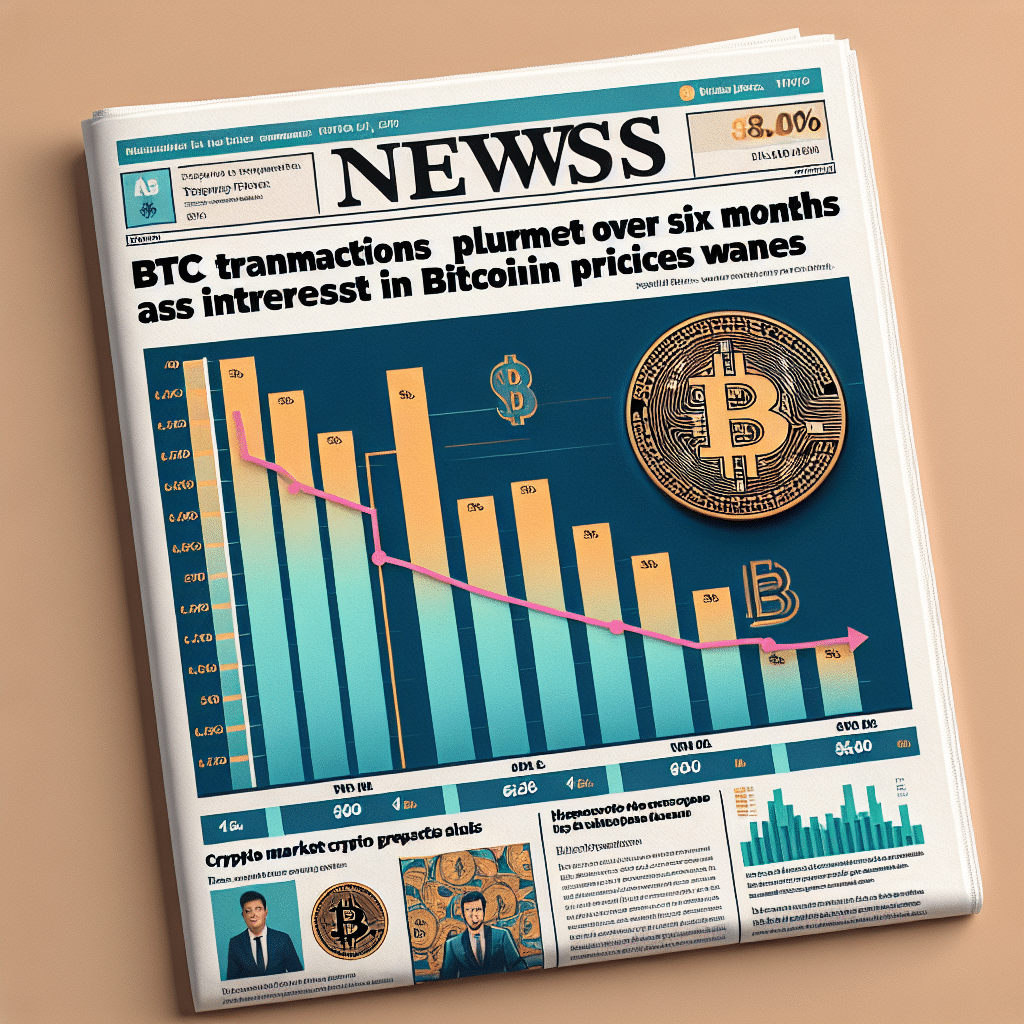

The Bitcoin (BTC) network has seen its active daily transaction numbers fall significantly. During the high of mid-March, when BTC/USD reached its most recent all-time high in US dollar terms, there were nearly 1.2 million daily active addresses. However, current figures have plummeted to just 838,000, with a notable dip in late August to as low as 744,000 active daily addresses. This downturn marks a stark contrast to the vibrancy experienced in 2021 when the price of Bitcoin hovered around $45,000.

This reduction in active addresses points to decreased overall activity on the Bitcoin network, suggesting that fewer transactions are occurring. According to CryptoQuant, an onchain analytics platform, this can be interpreted as diminished interest in utilizing the network during this phase of the market. Such a downturn feeds into a broader narrative of frustration and stagnation within the crypto market, as Bitcoin struggles to establish a definitive trend.

The Puell Multiple, a metric that assesses the value of daily mined Bitcoin against its 365-day moving average, further shows that the market is currently idling without clear direction. Despite these challenges, some market participants view this downturn as a potential long-term buying opportunity, anticipating a future rally.

BTC Price "Chopsolidation" Hints at Breakout

The current market landscape is also characterized by what’s been described as "chopsolidation," a blending of consolidation and erratic, or "choppy," BTC price movements within a confined range. This trend suggests that the market is ready for a movement, though the direction remains uncertain. Despite achieving various long-term lows, BTC/USD has yet to undergo a correction as steep as those observed in previous bull markets.

This analysis suggests that while the market is rife with uncertainty, it may also be gearing up for a significant shift. The erratic price movements and overall market stagnation serve as a reminder of the inherent volatility and unpredictability of the cryptocurrency market.

Considerations for Investors

The current market conditions present a mixed bag for investors. On one hand, the decline in active addresses and the ongoing price consolidation could signal an opportune moment for acquisitions, anticipating a potential market rally. On the other hand, these signals could also be interpreted as indicators of weakening or a loss of relevance for Bitcoin in the current macroeconomic context, necessitating the formation of new supports and reevaluation of investment strategies.

Investors are encouraged to conduct thorough research and consider multiple factors before making any decisions. The long-term outlook for Bitcoin, while currently uncertain, may present unique opportunities for those with a keen eye on market dynamics and an understanding of cryptocurrency trends.

FAQ

Q: What are active addresses?

A: Active addresses refer to the unique wallet addresses that engage in transactions on the blockchain within a specific timeframe, serving as an indicator of network activity.

Q: What is the Puell Multiple?

A: The Puell Multiple is a metric that compares the daily issuance value of bitcoins (in USD) against the 365-day moving average of the daily issuance value, helping to assess the market’s health and potential buying or selling opportunities.

Q: Is now a good time to invest in Bitcoin?

A: Investment decisions should be based on personal risk tolerance, market research, and an analysis of current market conditions. While some see the current market as an opportunity, others may view it with caution due to the prevailing uncertainty.

Conclusion

The Bitcoin market is currently in a state of flux, with transaction numbers at three-year lows and prices undergoing "chopsolidation." This scenario has resulted in a growing sense of disinterest among participants, though it presents a potentially critical juncture for investors. With careful analysis and a consideration of long-term trends, investors may find opportunities amidst the uncertainty. However, the inherent volatility of the cryptocurrency market calls for prudent decision-making and a strategic approach to investment.