Understanding the Impact of Mt. Gox’s Movements on Bitcoin’s Value

The cryptocurrency market constantly ebbs and flows, influenced by a myriad of factors ranging from global economic trends to the actions of individual entities. Recently, the Bitcoin community turned its focus once again towards the defunct exchange Mt. Gox, as significant movements were noted within its wallets. This article delves into the recent Bitcoin price fluctuations, investigates the causes, and evaluates the implications for the market’s future.

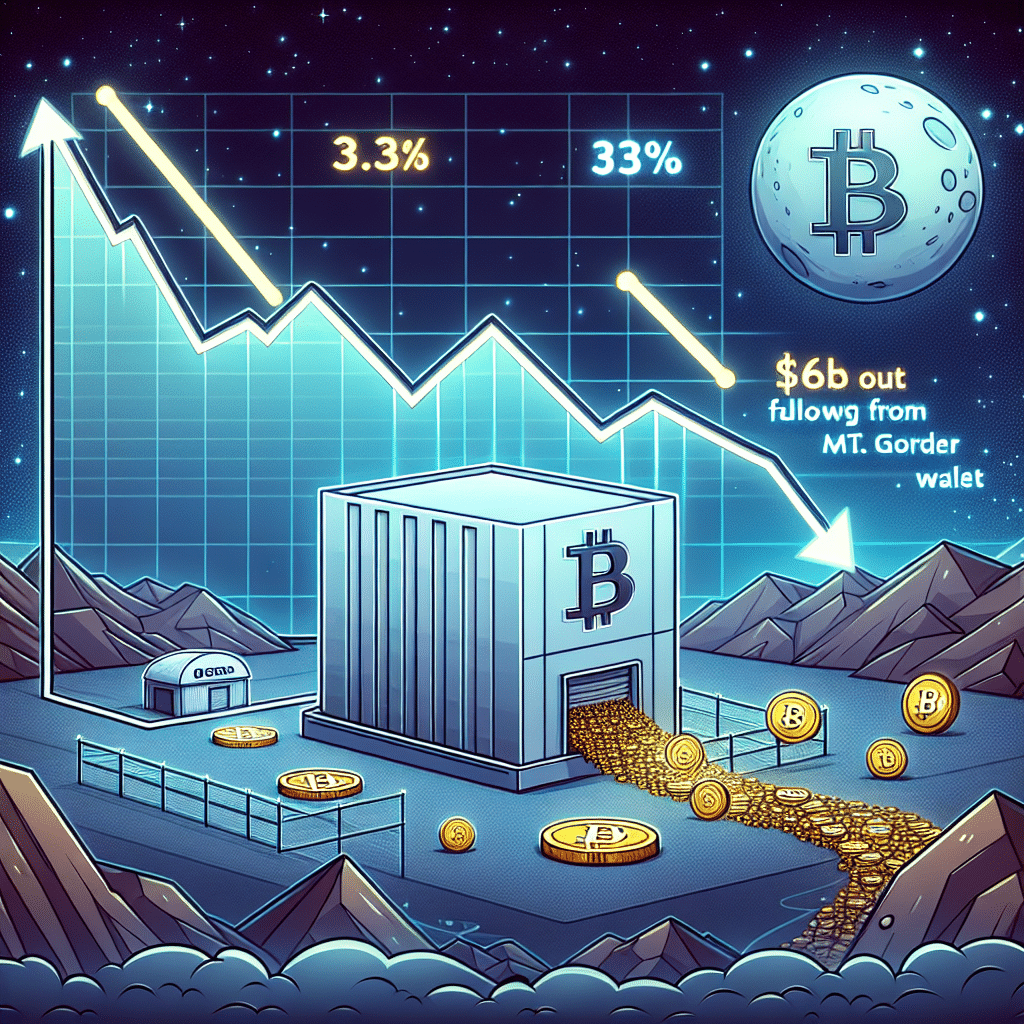

Mt. Gox Bitcoin Outflows Send Price Below $6,000

In a striking development, data from Cointelegraph Markets Pro and TradingView highlighted a downturn in Bitcoin’s price following notable activity related to Mt. Gox. The exchange, which closed its doors over a decade ago following a high-profile hack, is currently in the process of implementing a rehabilitation program for its creditors.

- Transaction Details: Analysis by crypto intelligence firm Arkham revealed that approximately 92,000 BTC, worth around $5.7 billion, were transferred from Mt. Gox’s cold wallets. This movement constituted about two-thirds of the total holdings of the exchange, sparking widespread speculation and concern among investors and analysts alike.

For further details on the transactions, visit Arkham for their comprehensive analysis.

- Market Reaction: The transfers were widely discussed, with onchain analytics platform Look Into Bitcoin noting that these could be preparations for repaying the creditors. The fear of mass Bitcoin sales following these repayments created a palpable sense of uncertainty, contributing to the price dip.

Despite the concern, some voices within the community, such as crypto investor Quinten Francois, suggested that the reaction might be more driven by fear, uncertainty, and doubt (FUD) than by the reality of the situation.

BTC Price Flirts with Key "Bull Market Trendline"

Concurrently, Bitcoin’s price trajectory was testing critical support levels that many analysts associate with long-term bullish trends.

- Market Analysis: Prior to this event, Bitcoin had been showcasing strong performance, with its value reaching $65,000 on June 21, a significant marker considering the cost basis of short-term holders. This figure, often seen as a measure of support during bull markets, had not been breached since August 2023, according to data from Look Into Bitcoin.

For an in-depth understanding of Bitcoin’s short-term holder cost basis, visit Look Into Bitcoin.

FAQs

Q: What is the significance of Mt. Gox in the Bitcoin ecosystem?

A: Mt. Gox was once the world’s leading Bitcoin exchange, handling over 70% of all Bitcoin transactions at its peak. Its hack and subsequent bankruptcy in 2014 was a pivotal moment in the cryptocurrency world, highlighting the importance of security in digital asset exchanges.

Q: How does the movement of Bitcoin from cold storage affect the market?

A: Large-scale transfers from cold storage to active wallets are often interpreted by the market as a precursor to selling, which can lead to speculation and, consequently, price volatility. The anticipation of a significant amount of Bitcoin hitting the market can cause investors to adjust their positions, leading to a price drop.

Q: What is a "bull market trendline"?

A: A bull market trendline is a tool used by investors to gauge the market’s trajectory. It is drawn across the lows of a market’s price chart and is intended to identify the support level that must be maintained for the bull market to continue.

Conclusion

The recent Bitcoin price movements underscore the profound impact that entities like Mt. Gox continue to have on the cryptocurrency landscape. While the fears of a market flood with Mt. Gox’s Bitcoin holdings might have contributed to the price dip, it’s essential to distinguish between short-term reactions and long-term trends. As the cryptocurrency ecosystem matures, it becomes increasingly resilient to individual events, but not immune. Investors and enthusiasts alike would do well to remain informed, stay vigilant, and consider the broader context when navigating the ever-evolving crypto sphere.