A Step-by-Step Guide to Mastering Crypto Day Trades

Day trading crypto means fast decisions, sharp focus, and high risk. This guide breaks down how to day trade bitcoin and altcoins with structure, strategy, and control.

On this page

Crypto never sleeps, and neither do the markets. For traders looking to profit from short-term moves, day trading bitcoin and other digital assets offers speed, volatility, and real-time decision-making. But it’s not about luck. Successful crypto day trading requires, you need structure, discipline, and a clear plan.

This guide will walk you through the full process of crypto day trading. You’ll learn how to analyze the market, manage trades, track performance, and apply proven strategies with confidence.

What’s day trading in crypto

Day trading crypto means buying and selling digital assets within the same day to profit from short-term price movements. Unlike long-term investors who hold assets for months, day traders aim to capitalize on the crypto market’s volatility for quick gains.

Can you day trade crypto? Yes. The constant price fluctuations in crypto create multiple opportunities throughout the day.

But success in day trading takes more than luck. It requires focus, strategy, and the ability to react quickly to market changes. In the following sections, we’ll walk through the key steps of day trading, from analyzing news to reviewing your performance.

How to day trade crypto

To day trade crypto effectively, you need a structured approach. While the market moves fast, successful traders rely on a clear set of steps, not guesswork. These steps apply whether you’re trading altcoins or focused on day trading bitcoin.

Below are the core stages of the process. Mastering them is essential for anyone looking to take crypto day trading seriously.

Analyze market and news

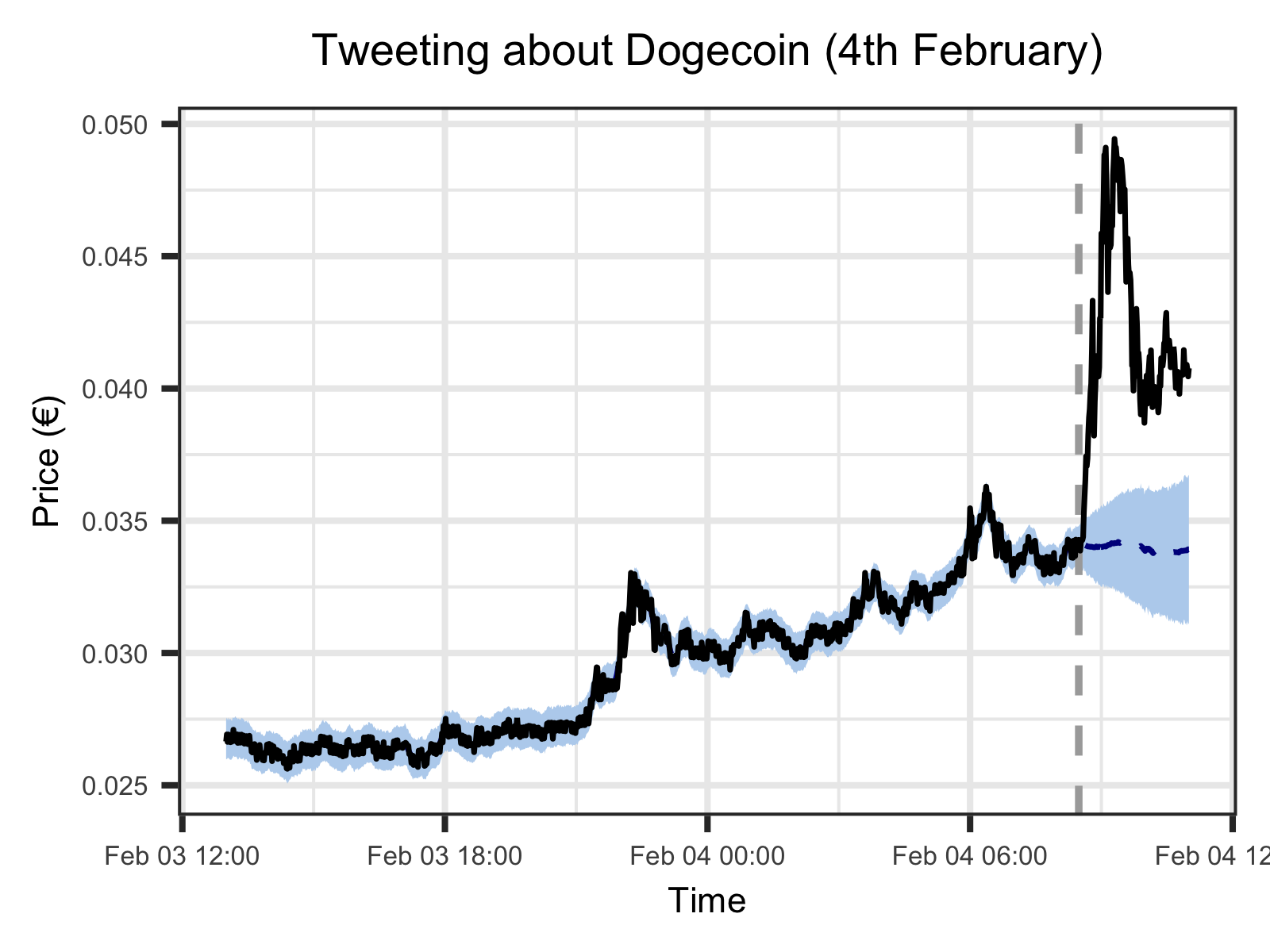

Before you day trade crypto, you need to know what’s moving the market. That means checking price charts, tracking volume, and scanning news feeds for headlines that could trigger volatility.

Look at major economic updates, regulatory shifts, or unexpected events like exchange hacks or token delistings. Even a tweet from a major figure can move the price in minutes. Pay close attention to figures like Elon Musk and Donald Trump. Statistically, their statements have the strongest impact on the markets.

The goal isn’t just to react but to anticipate — to understand why a coin might pump or dump before it happens. Solid analysis helps you filter out the noise and focus on setups that actually matter.

Identify key levels and trading pairs

In crypto day trading, knowing where to look is half the job. Before you enter a trade, you need to define support and resistance levels. These are price zones where an asset tends to bounce or reverse. They help you decide when to enter and when to exit.

Also, choose your trading pairs carefully. Day trading bitcoin is popular for a reason: high volume, tighter spreads, and better execution. However, altcoins with strong momentum can offer solid opportunities too. Stick with pairs that fit your risk tolerance and trading style.

Plan entry, exit, and risk

Every trade needs a plan. Before you click buy, you should already know your entry point, your profit target, and where you’ll cut losses.

Use support and resistance levels to set these boundaries. Decide in advance how much capital you’re willing to risk on a single trade. Many traders adhere to the one-percent rule, risking no more than one percent of their total account per trade.

Without a plan, emotion takes over. That’s when hesitation, revenge trades, or holding onto losers can ruin your day. Planning keeps you disciplined and gives your trades a clear structure.

Study trading psychology to avoid falling victim to your own biases. Record not just your analysis but your emotions. Tracking your mental state is just as important as tracking your trades.

Execute and monitor trades

Once your plan is in place, it’s time to act. Enter the trade using limit or market orders, depending on your strategy and how fast the price is moving. Stick to your predefined entry point. Don’t chase the market.

After execution, monitor the trade. Watch how the price reacts around key levels, and stay alert for news that could shift momentum. But avoid micromanage. Let your stop-loss and take-profit do their job unless something truly changes your setup.

You can also create your own position management rules. These often include strategies like partial profit-taking, adjusting stop-loss levels, or moving to breakeven.

Review performance

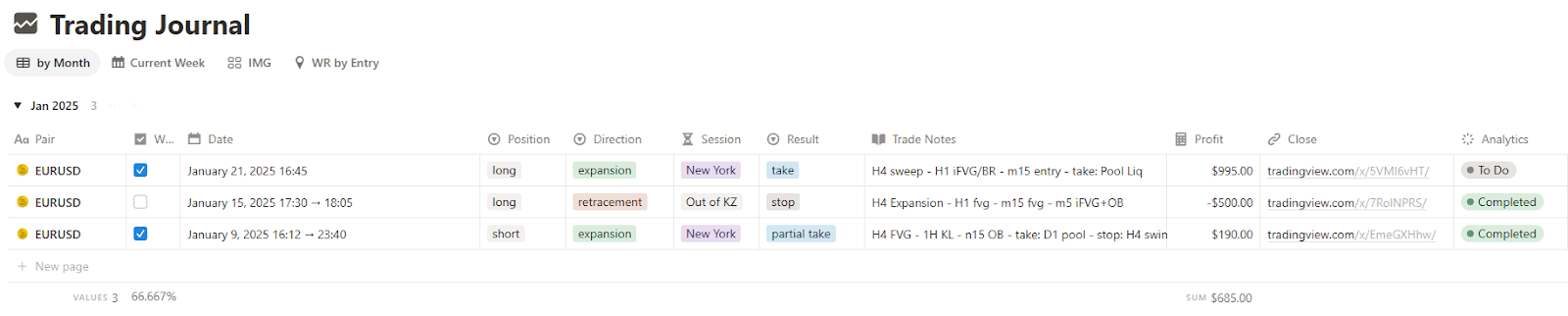

Every trading session should conclude with a review. In daytrading crypto, your long-term success depends not only on your strategy but on how well you evaluate and refine it over time. A solid review process helps you recognize patterns, eliminate mistakes, and double down on what works.

Start by logging the essentials: entry and exit points, trade size, risk percentage, profit or loss, and reasons for taking the trade. But don’t stop there. Track your emotional state, confidence level, and external factors like news or market conditions. This adds crucial context that raw numbers miss.

To make this process easier, use the right tools. Each has its own strengths.

Notion. Notion is a flexible all-in-one platform where you can build custom databases and link them together. For daytrading, this means you can track trades, emotions, strategies, and even journal entries in one place. In the paid version, you also get charting capabilities to visualize performance over time. If you want full control over your workflow, Notion gives you that freedom.

Excel. For straightforward trade tracking, Excel is a classic choice. It’s perfect for logging primary metrics like trade volume, risk percentage, entry and exit prices, profit and loss, and overall deposit growth. Use formulas to automate basic analytics, and build simple dashboards to spot trends. It’s not fancy, but it’s fast, accessible, and gets the job done.

OneNote. OneNote works well as a trading journal, especially if you prefer a freeform, notebook-style format. You can organize notes by trading day, paste in screenshots of charts, and jot down your thoughts right after a trade. Its sectioned layout makes it easy to track emotional insights, market commentary, and strategy tweaks in a more narrative way.

By combining hard data with emotional and contextual review, you’ll gradually turn experience into insight. This is what separates short-lived hype from long-term skill in daytrading crypto.

Best crypto day trading strategies

There’s no single formula that works every time, but several proven methods can help you daytrade crypto more effectively. Each approach has its own logic, tools, and risk profile. Different strategies work better in different market conditions.

Whether you’re day trading bitcoin or exploring altcoin setups, the strategies below form the foundation of most successful intraday trading. Let’s break down the core ones.

Trend trading

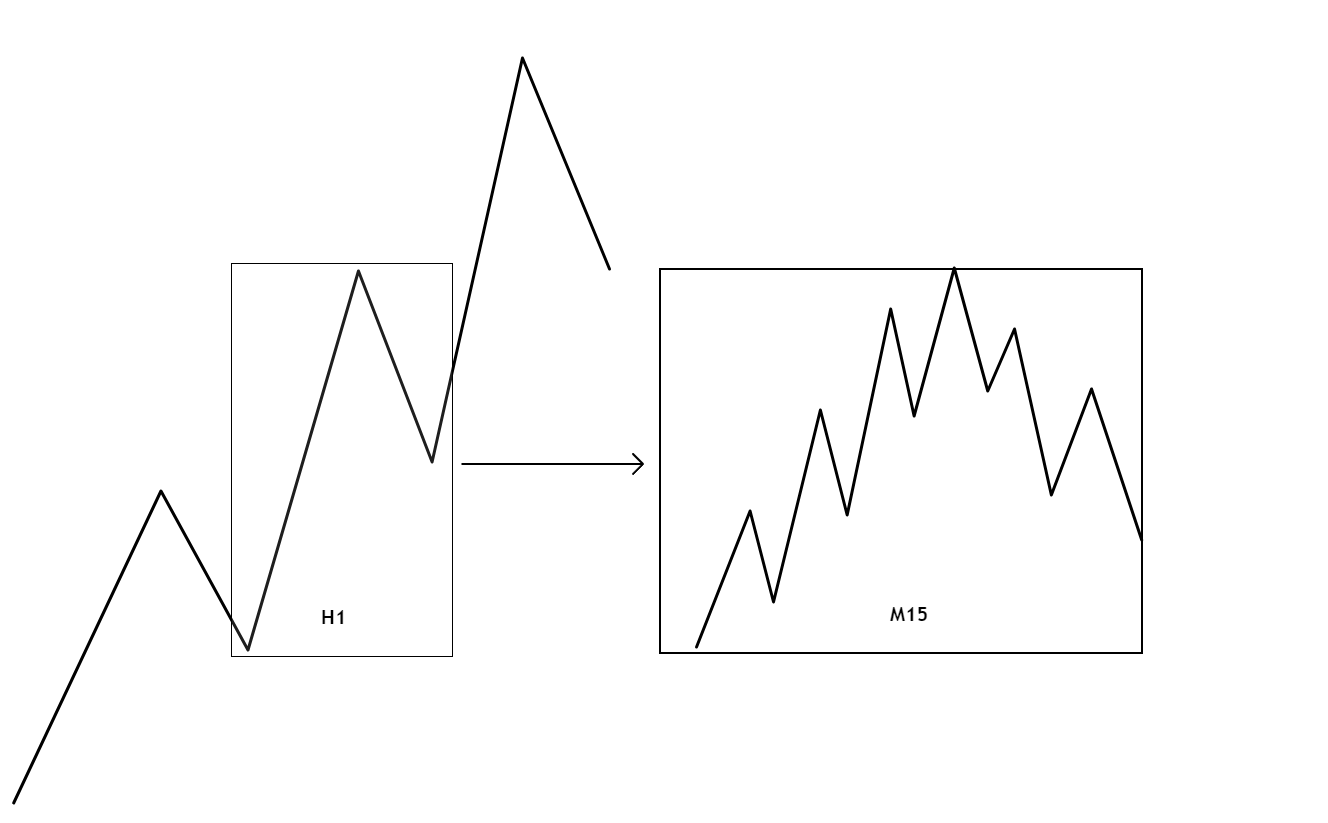

Trend trading is built on one principle: trade in the direction of the market. If the price is rising, you look for long opportunities. If it’s falling, you look for short setups. The aim is to enter early and ride the move until the trend shows signs of fading.

One of the strengths of this strategy is its flexibility. You can trade short-term trends that last minutes or hours, or focus on longer intraday moves that play out over the full trading session. The logic remains the same – the only difference is how long you hold the position.

Trends form on all timeframes. Whether you’re using a five-minute chart or a four-hour one, the market still moves in waves. What changes is the speed and scale of those waves. That’s why trend trading works for both scalpers and swing-oriented day traders.

To spot and follow trends, use tools like moving averages, price structure (higher highs and higher lows), volume spikes, and confirmation from indicators like the MACD or RSI. Avoid guessing reversals. Trade what’s visible and stay with the momentum as long as it holds.

Range trading

Range trading focuses on sideways markets, where price moves between support and resistance without a clear trend. Instead of following momentum, you aim to buy low and sell high within a defined zone.

The strategy works best during periods of consolidation, often after strong moves or when major news is lacking. Look for multiple touches of both support and resistance levels. The more times price respects those levels, the more reliable the range.

Entry points are typically near the bottom or top of the range, with confirmation from indicators like RSI or volume drops. Stop-loss orders are placed just outside the range to protect against breakouts, while take-profits are set near the opposite boundary.

Range trading is slower and more methodical than trend trading. However, in choppy markets, it can be one of the most consistent ways to generate returns.

Arbitrage

Arbitrage is about exploiting price differences for the same asset across different markets. In crypto, this usually means buying a coin on one exchange where it’s cheaper and selling it on another where it’s priced higher.

There are a few types of arbitrage:

- Cross-exchange arbitrage is the most common and involves quick execution between platforms.

- Triangular arbitrage works within one exchange by taking advantage of price discrepancies between three trading pairs.

- DeFi arbitrage looks for inefficiencies between decentralized protocols.

While arbitrage seems low risk, it requires fast execution, good liquidity, and low fees. It also comes with infrastructure challenges — delays, withdrawal limits, or network congestion can easily erase your edge.

Still, in a market as fragmented and volatile as crypto, arbitrage remains a powerful option for skilled and well-equipped traders.

Is day trading crypto worth it?

It depends on your goals, temperament, and discipline. You can day trade crypto successfully, but it takes more than watching candlesticks and chasing pumps. The volatility that creates opportunity also brings serious risk.

If you’re consistent, focused, and able to stick to a process, day trading can be profitable. It offers fast feedback, flexibility, and the chance to build skill over time. But for many, the pressure, noise, and emotional swings aren’t worth it.

If you’re expecting easy money, it’s not for you. If you’re ready to treat it like a craft, track your performance, and improve with intention, then yes, day trading crypto can be worth it. In this game, the market rewards those who respect the process.

The information published on CoinRevolution is intended solely for general knowledge and should not be considered financial advice.

While we aim to keep our content accurate and current, we make no warranties regarding its completeness, reliability, or precision. CoinRevolution bears no responsibility for any losses, errors, or decisions made based on the material provided. Always do your own research before making financial choices, and consult with a qualified professional. For more details, refer to our Terms of Use, Privacy Policy, and Disclaimers.